Author Background:

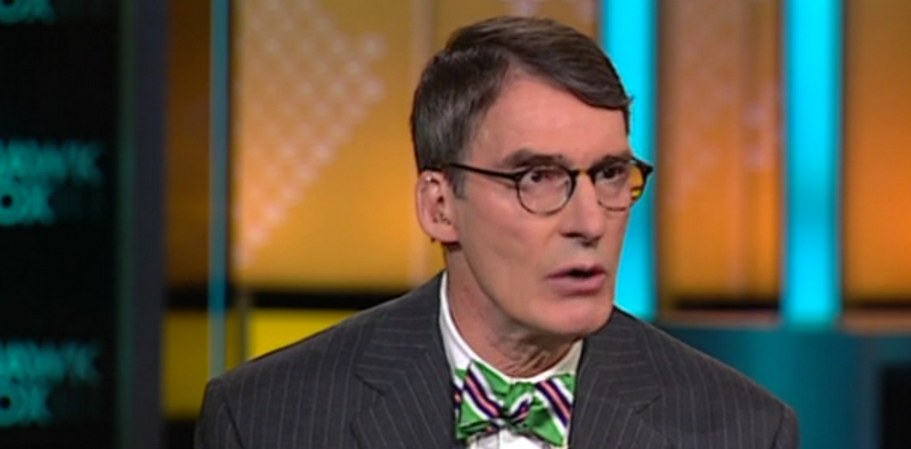

James Grant is a financial journalist, historian, and the founder and editor of Grant’s Interest Rate Observer, a twice-monthly journal of the investment markets. His new book, The Forgotten Depression, 1921: the Crash that Cured Itself, is a history of America’s last governmentally unmedicated business-cycle downturn.

Jim’s Book Recommendation:

Audio Podcast:

Other ways to listen:

* On iTunes

* Right Click + Save As to download as an MP3

* Stream here directly

With gratitude,

Transcript:

Jake: Hi, welcome to Five Good Questions. I’m your host, Jake Taylor. Our guest today is James Grant.

Jim is a Financial Journalist, historian and the founder and editor of Grant’s Interest Rates Observer, a twice monthly journal of the investment markets. After receiving the BA in Economics from Indiana University and a Masters from Columbia in International Affairs, Jim became a reporter at both the Baltimore Sun and Barron’s.

He’s the author of numerous books. His newest, The Forgotten Depression 1921: The Crash That Cured Itself. It’s a history of the last time that the US Government declined to interfere in the business cycle. Let’s ask him five good questions.

Hi everybody! Our guest today is James Grant, author of The Forgotten Depression. Jim, I really appreciate you coming on the show today.

James: Jake, it’s my pleasure. Nice to be here.

Jake: I have to admit that I’m actually a bit of a Jim Grant fan boy. It’s very rare to find somebody that appreciates both Ben Graham and von Mises. So it’s kind of my special honor today.

James: Well, thank you so much.

Jake: Jim, you’re ready for our five good questions?

James: I am. Shoot, Jake.

Jake: Alright, number 1. So your book is basically about this era in history in 1921 in the US where we had a depression. And the government basically was hands off and didn’t take a whole lot of action. Could you kind of walk us through like that’s the cliff notes version of what was going on in the world leading up to 1921? And then kind of what was the general economic world look like then?

James: Yeah, I’ll be happy to. Of course, what causes the depression was some good part of the preceding boom. And there was a boom coming out of the First World War. But more time necessarily as a time that’s almost always is a time that’s inflationary in finance.

World War I was no exception. If you actually borrow a lot of money, the Fed finance that money to minimal rates. It’s a great boom in the lending and borrowing was the predictable inflationary consequences.

Now for the most of history, the after math of most major wars has been deflationary. And people expected an immediate deflation come the Armistice in 1918. But Mr. Market confounded those expectations and prices instead of falling continue to levitate.

Now as you know, Jake, prices in the market economy are traffic signals. They direct investment and effort. And prices as they kept rising, induced entrepreneurs and wager earners and farmers to do more of what they had been doing which is to say overdue what they have been doing. So General Motors build a great big headquarters building and a haberdasher in Kansas City, Missouri named Harry S Truman opened up shop thinking there were not enough places in Kansas City to buy suits and neckties. And farmers planted fence post to fence post.

So that was the set up. The world was at peace but it was not a happy place. And influenza pandemic was even more lethal than the First World War But the world picked itself up and got the business and expected boom times. But the world was disappointed in the spring of 1920 crisis broadly worldwide began a great plunge. Never before had prices fallen so far in such a short period of time. All commodity prices on average were down by 40.5% before the deflation ended about 8 or 9 months later. Our stock prices were down 45% whether that’s industrial production collapsed, unemployment went sharply higher. What to do?

Well, what the government did was principally nothing but it balanced the budget. And the newly formed, still wet behind the ears, Federal Reserve actually raised interest rates rather than lower them. So Jake, the question before the house is why do this depression ever end. It was met after all by policies that both monetarist and Keynesians today would characterize as medieval. Yet 18 months after its official beginning, the depression bottomed out and they’re ensued the proverbially Roaring Twenties.

Jake: And so what was the Feds action at the time as all of these deflationary happenings were going on? I mean, in today’s day, we would expect them they’d be printing money like crazy, lowering interests rates. What do they do then that is so different?

James: Well, they did exactly the opposite. The Fed then was under constraint of the post World War I gold standard. But nearly so well shaped or rigorous as its classical predecessor which ended in 1914. But still, there was that constraint on the Fed’s actions. More than that, there was a constraint of the Fed imposed upon itself. It believes that the price level had been disastrously inflated through war time finance. And it met to be the agent of the restoration of the normalized prices and wages.

And Benjamin Strong who was authentically the editor of the Federal Reserve System, but normally merely the President of the New York Federal Reserve Bank, had confided in letters that he was all for deflation. He meant it not as an inhumane or as a cruel thing but rather as a constructive thing. After which he thought, after prices had normalized, America would be off for the races with an almost, as he said, impregnable banking situation. So that was unfair then, he said, as you note a very different animal.

Jake: Yeah. Well, like they actually believe that liquidation was a necessary evil that you had to take your medicine and then you could move on.

James: They did. They did indeed. And to that end, they have raised interest rates in the face of collapsing commodity prices. And we can’t really appreciate just how violent was this collapse. But it took away the breath of people who have seen depressions of the 1890s and even some gray beards who had been around 1870s. The world have not seen quite anything like this. It began in Japan with the silk market and it rolled its way around the world. In America, it was a site to behold. A very frightening one.

And in the face of these collapsing prices, the Fed raised, raised mind you, the discount rate 6, 7; I think 1.8%. When set along the side, a rate of collapse about 40% per annum prices, these real interest rates, inflation and just the interest rates were strangulated. Very, very constricting.

Jake: Yeah. But then you had wages to fall along with it so that businesses could be profitable again. And then get back to…

James: Well, that to me is the key difference between this our last governmentally unmedicated business cycle down term and cycles that followed. And you said, wages did fall not quite so fast. By no means so fast, actually, it’s the crops and commodity prices. But wages did fall. And in falling, they helped to synchronize cost and profit margin again so that the upturn will be profitable.

Jake: Right. Yeah, which is what you needed to get back to a healthy footing. So let’s jump to question #2.

James: Oh, that was only question #1? My goodness.

Jake: Yeah, that was just question #1.

James: Okay.

Jake: You know, they don’t have to be as long as that. This kind of speaks to; it’s along the same lines. But during 2008, George Bush was quoted the saying, “If money hasn’t loosen up, these suckers going down.” And, you know, Warren Buffet talked about it as if there was an economic Pearl Harbor.

I think one of the issues that we have today is that economics suffers from physics envy like a hard science. And they’d like to think that they have more control over this machine then I think maybe it’s, well, actually possible.

What do you think? Do you think that this 1921 data point is scientific enough to provide almost like a control group in a scientific experiment of what would have happened in 2008 had we not intervened as much as we did?

James: I think not. There’s nothing like scientific precision, of course, in historical analogy. It is only an analogy. And of course, needless to say, so much is different. Like in America, it’s massively bigger in its productive power and its wealth and in complexity of its financial arrangements. And of course, in the structure of its financial government, the Federal Reserve today is kind of it’s all intrusive. People expect it to be all intrusive. Wages are never to fall, the prices ditto. The Federal Reserve wants them only to rise so we can’t exactly superimpose events of a distant era.

However, Jake, in 2008, the 1930s was the episode that monopolized the market in historical analogy. People only park back to the 30s and they said, do you know unless we do this and that, we will suffer the Great Depression again. Well, 1920 and 21 is not a scientific data point but it is a suggestive observation on the resiliency of markets and on the behavior of people in markets.

And so for that reason alone, it is very useful. It’s not going to prove anything. We can’t prove a counter factual. We can’t, of course, imagine what’s things should be like as if 1921 with all of its institutional arrangements were brought forward to the present day. But we can observe that with unchecked market action was the free play of a price mechanism. But bad things happen. But those bad things happen expeditiously. And that what followed the closing of that cycle of bad things was many years of growth and invention and enterprise and prosperity.

So I don’t expect anyone to use 1920, 21 as a precise template for our future action. But I would hope that this era of our history enters the conversation and it makes a mark on these supposed students of the 30s such as Ben S. Bernanke, PhD, who for once could pay attention to something outside his immediate field of vision.

Jake: Yeah. Our question #3 is kind of more a thought experiment. But I think, given your background and your historical research, are going to be interesting to hear about your thoughts on this. I’ve often wondered what the world would look like if we actually had all of the deflation and prices that all the technology that we’ve had over the last hundred years would have been reflected.

So what I mean by that is like the cost of producing things keeps dropping as technology makes us more efficient. You know, computer prices drop in half every 18 to 24 months according to Moore’s Law. Yet if you look back like from 1913 today, we’ve lost, what? Like 93, 94, 95% of our purchasing power of a dollar. So what would the world look like if we had had a stable money system as opposed to in attempt at stable and I’m putting that in quote, “stable prices” of 2 to 3% upward drifting inflation all the time?

James: Well, we can look back to the final quarter of the 19th century which is the time of great technological progress and innovation and kind of scare discontinuities in the way people did their work. And people, they were displaced. They were disrupted. They were alarmed with the new things. But there was no Federal Reserve to insist that money be created such that the natural decline or dwindling in average prices would be reversed through monetary means.

So according to Friedman and Schwartz, think prices fell over the final quarter of the 19th century by about 1.5 or 2% a year which was a great boom at the time to those not in debt. Real wages rose. It didn’t fall. And of course, the fruits of enterprise and of invention were widely distributed. So that was one observation.

We can also look with 1920s, another time of very rapid progress in productive technique. By the 20s, the Central Bank had come around to believing the Irving Fisher view that stability ought to be imposed through monetary policy but, well, not to suffer either a rising or a falling level of prices. The Central Bank has attempted to bring the stability out by purchasing government securities what we call open market operations. And sure enough during 1920s, that the price level remained largely unchanged.

But a very interesting and I think persuades that school of thought was the artificial suspense of the price level that was in good part responsible for the disruptions that followed in 1930s. So I’m all for everyday lower and lower prices. That works for Walmart. That works for Silicon Valley. And I think that the drum beat here from Central Bank is about the parallels of the inflation is a theory with very little evidence and a great deal of harm built into it.

Jake: Yeah, I think that’s everybody’s space especially in the mainstream is brainwashed into “Oh, deflation is bad. We must avoid deflation at all cost.”

James: Yeah. They don’t define it, Jake. I mean, what is deflation. One must distinguish, of course, between clashes of thoughts because of a debt crisis. And during the debt crisis, people needing funds must sell something to raise those funds. They can’t borrow. And force selling during a debt predicament is what I call deflation that is not a wholesome event. It’s recurrent and it’s not what we want. But prices that fall on the account of the improvement of the species like how much improvement in technology. Will we call it progress? I mean that the Central Bank has never distinguished between the deflation and progress. And I think that distinction is critical.

Jake: Yeah. Yeah, exactly. That’s the whole point of technology, right?

James: You think?

Jake: Yeah. Alright, let’s jump to question #4. And this question goes towards the view of the economy that I think a lot people more in the maybe Austrian camp have that, and I’m actually borrowing this phrase from the Nassim Taleb that the economy is more like a cat than it is like a washing machine. And the idea behind that is that it’s more like a complex adaptive system like Mother Nature that is very hard to predict and is non-linear versus the idea that we can tinker with interest rates and it’s this math problem to be solved by some academic bureaucrat.

What are your thoughts on that like where do you come down on that? Do you think that we should have totally free market interest rates? Or do you think that the Fed could had it actually try to keep us stable money or stable money supply? Not necessarily stable prices but like maybe could smooth out a little bit of the fluctuations by stepping on the gas a little bit in like a down term. But also which we haven’t had in 80, 90 years raising interest rates in the event of when there seems like there’s over speculation. What do you think about that?

James: Well, it’s very big question, question #4.

Jake: Yeah, it’s not a small question.

James: Yeah. As to nature of the economy, what’s interesting is that in 1920 and 21, the very concept of the economy had not been invented. But people talked about enterprise. They talked about bad times, good times like a depression. They’ve talked about booms. The word macroeconomy was not current. Nor were there data to support a top down view of the economy in all its complexity. I do sympathize. In fact, I kind of relish that constructive ignorance of not doing with regards to what we and I can see call the economy.

The economy is like a cat or it’s a Labrador retriever or something but it’s living. It’s kind of a human being that is responsive to incentives and the stimuli and it’s going to surprise you. Think how often the stock markets surprises even the most knowledgeable and talented practitioners. It’s because it’s the human organism.

So I take as my model of macroeconomic management of Hong Kong under a man named Cowperthwaite who was the Secretary of Finance of Hong Kong in 1961 to 71, I think. Mr. Cowperthwaite, I think, Sir John Cowperthwaite ruled that he wanted no data collected lest some bureaucrat attempt to use those to figures to manage what was the perfectly functioning free market enterprise. So I sometimes wonder, Jake, whether we aren’t always kind of under the spell of kind of a statistical hypochondria. We are confronted every day with a new battery of emissions from the government’s statistics bureau. To ensure many of them subject to significant revision but our policy makers are dated dependent. I mean, I think, we need fewer data and more thought.

So that did not answer question #4. Nor am I capable of it.

Jake: Yeah, that’s yes.

James: On to five.

Jake: Yes. Okay. Number 5, okay. And this, there is much talk about too big to fail as this concept. Where there systemically risky banks back in 1920-21 time frame? And if so, what happened to those banks if like it’s clearly there was bad loans made and they were insolvent institutions; what happened to those without a government to come in and bail them out. How do we fix that?

James: Well, good question. In the first place, the experience of the American banking business in 1920, 21 was quite good. Banks did fail but not so many. And they were almost invariably small farm banks without diversification of assets or deposits so that the big city banks came through. Now some of these big city banks were in trouble.

Today’s accident-prone Citibank have its predecessor National City Bank. And the ancestor to today’s Citi was apparently also accident-prone. It was also heavily overextended in Cuba against the price of sugar which the price really collapsed. And guaranteed trust company which later was absorbed in to the Morgan Bank and still later until JPMorgan Chase was in difficulties. And these banks got through it. They were private rescue and liquidity injections. They are the Fed Reserve lent against good collateral.

What was, I think, instructively different about the concept of banking safety then was that the stockholders of a national chartered bank put themselves responsible for the solvency of the institution in which they held a particular interest. And if that institution became impaired or insolvent, they got a capital call. They had to stop up more equity over the terms of their investments.

Jake: It’s end of the game.

James: Yeah. Well, yes. And then they got the dividends, right? When the going was good, why shouldn’t they be responsible if the management whom they elected became, you know, made mistakes such that imperil the bank. So I’d like that a lot. I like the double liability feature of American banking which disappeared and then banking reforms at about 1935. But that was the great difference. Frankly, leveraged national institutions can fail. If poorly managed, they are all too likely to fail.

So there’s always going to be some trouble. But what was different about the era before the 1930s was the personal responsibility of the owners of these banks and the insolvency of institutions in which the invested. Very wholesome, I might add.

Jake: Yeah, I think that we all agree that you’re going to pay a little bit more attention to your underwriting standards if it’s your own money on the line. And instead you’re not just only getting the bonus if it works out. And then the taxpayers holds the bag if it doesn’t.

James: Just a couple of years ago, I’ve tried to publicize an idea. My friend, Paul Isaac, who said if you want to be… So we’re probably not going to go back our stockholder riot, the double liability for bank stockholders, but why not a clawback provision for bonuses and for compensation if the bank feels. And some that, I think, has gained some traction. But certainly the idea of ownership, of owning not only bearing, not only taking risks but also bearing risks. Bankers took risk in 2005 and 6. It didn’t get rid of that risk.

Jake: Yeah, huge difference. Well, Jim, that’s all the time that we have today. I really appreciate you coming on and sharing your insights with us.

James: Well, it was pleasure, Jake. Thank you.

Jake: And we got your book right here, The Forgotten Depression.

James: Ah, the merchandise, excellent.

Jake: Yeah, pick this up if you want to different view different view point of the same old 1930 Great Depression as the only thing that we have to go off of and too big to fail and also just some great historical anecdotes. I learned a ton of things about that time period that I didn’t know. So Jim, thank you very much.

James: You’re welcome, Jake. So long.

Jake: Alright.